Confusion between "selling" and "catering" is a top source of TABC violations. If money changes hands, it is a sale requiring a permit. If the host pays, it is service. We define the critical "transaction" point to help you determine if your DFW private event legally requires a Temporary Event Approval.

Event Location Restrictions for TEAs in Dallas–Fort Worth

Timing and Alcohol Storage Considerations for DFW Temporary Events

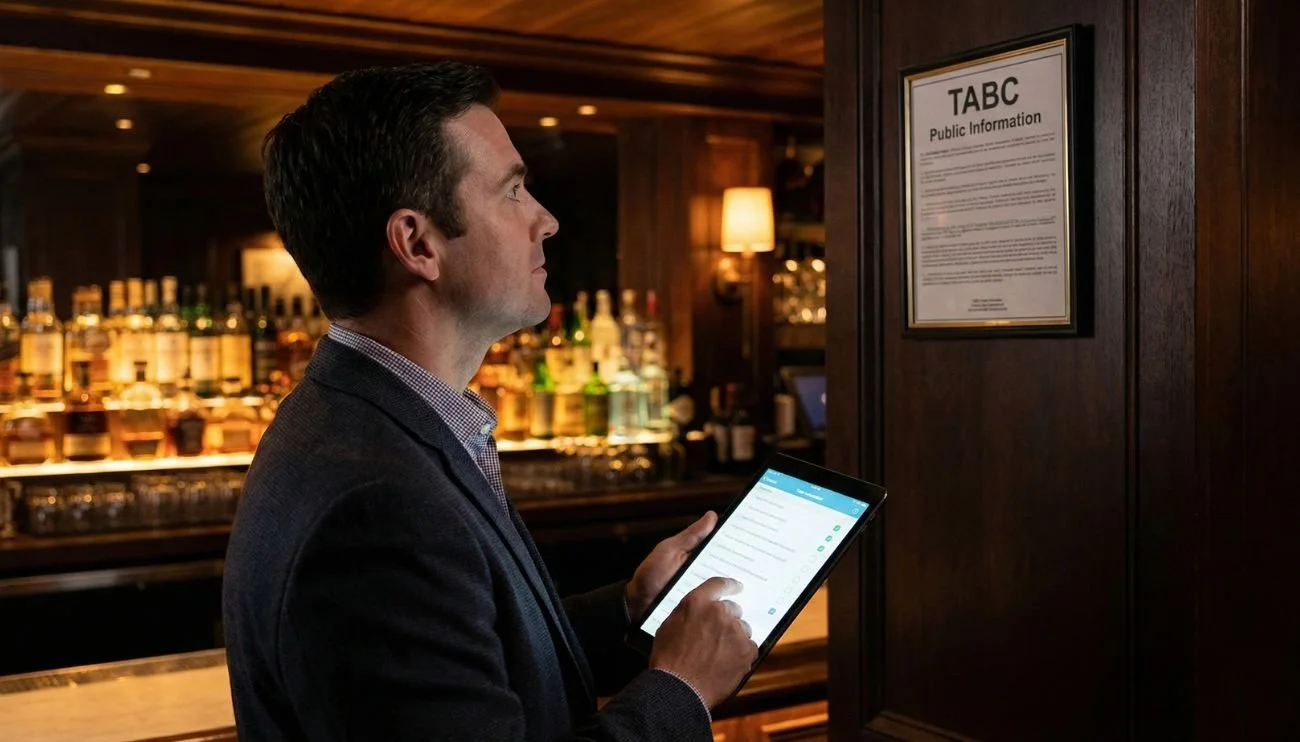

Understanding TABC Compliance Reports for DFW Permit Holders

The TABC Compliance Reporting window opens soon. Every two years, permit holders must file this mandatory report via the AIMS portal. We guide you through the digital checklist—from verifying physical signage to confirming ownership details—to ensure your DFW business avoids administrative blocks on your license.

Required Alcohol-Related Signs for Dallas–Fort Worth Bars and Restaurants

You cannot just hang your permit in the back office. TABC requires specific signs, like the Public Information and Human Trafficking posters, to be clearly visible to guests. We list the mandatory signage for DFW bars and explain why a "compliance wall" is your best defense against inspection citations.

Purchasing Alcohol in Dallas–Fort Worth: What Permit Holders Must Know

You cannot restock your bar at a retail store like a regular customer. Texas law mandates that permit holders purchase distilled spirits only from authorized "Local Distributors." We explain the strict Three-Tier System, how to identify the required Texas Tax Stamp on bottles, and why keeping compliant invoices is your only defense during an audit.

Alcohol Promotions and Drink Special Restrictions in DFW

Core Requirements for Opening a Bar or Restaurant in Dallas

You cannot apply for a TABC permit until your location is approved locally. In Dallas, this means securing a Certificate of Occupancy (CO) and passing a rigorous three-step approval process: City zoning verification, County Clerk certification, and State Comptroller approval. We map out the order of operations to prevent expensive delays.

Temporary Event Approvals: A Guide to Off-Premises Alcohol Service in Dallas

Avoiding Minor Sales and Holiday Sting Operations in Dallas–Fort Worth

Understanding Mixed Beverage Taxes for Texas Liquor License Holders

Mixed Beverage Taxes in Texas encompass two distinct types of taxes applied to the sale of alcoholic beverages by businesses holding specific permits. These taxes are designed to regulate the alcohol industry within the state, ensuring compliance and generating revenue for public services.

Who Pays Mixed Beverage Taxes?

The responsibility of paying mixed beverage taxes falls on entities holding Mixed Beverage (MB) and Private Club (N) permits. These permit holders are typically businesses like bars, restaurants, and clubs that sell alcoholic beverages directly to consumers for on-premises consumption. The Texas Alcoholic Beverage Commission (TABC) issues these permits, and permit holders are obligated to comply with state taxation laws, including the filing and payment of mixed beverage taxes.

Taxable Items

Taxable items under the mixed beverage taxes include all alcoholic beverages such as beer, wine, and distilled spirits sold, prepared, or served by the permit holder. Additionally, nonalcoholic beverages and ice sold, prepared, or served to be mixed with an alcoholic beverage and consumed on the premises also fall under taxable items. It's worth noting that the sales tax permit is also required for businesses holding Texas liquor licenses.

The Two Taxes Explained

1. Mixed Beverage Gross Receipts Tax:

This tax is imposed on the gross receipts from the sale of mixed beverages. The rate is 6.7 percent (.067) of the gross receipts, paid by the permit holder. It is crucial to understand that this tax cannot be passed on to the customer as a separate charge or deducted from the amount received by the sale of mixed beverages.

2. Mixed Beverage Sales Tax:

Unlike the gross receipts tax, the mixed beverage sales tax can be collected from the customer, in addition to the sale price of the drink. The current rate is 8.25 percent (.0825) on sales of mixed beverages. Permit holders have the option to either add this tax as a line item on the bill or include it in the sales price of the beverages. However, they must maintain records to show that the sales price of alcohol includes the mixed beverage sales tax.

Navigating Mixed Beverage Tax Reporting

Texas businesses holding a Mixed Beverage (MB) permit or a private club permit (N) are subject to specific tax reporting requirements mandated by the state. This guide aims to demystify the process, ensuring permit holders are well-informed and compliant with the Texas Comptroller’s regulations.

Reporting Commencement

The obligation to report mixed beverage taxes commences not when a business opens its doors to the public but from the moment a Texas Alcoholic Beverage Commission (TABC) permit is issued. This distinction is crucial for new businesses preparing for operation.

Mandatory Reporting

Regardless of whether taxes are owed, reporting is mandatory. This includes periods where there may be no sales. Failure to report can lead to estimated tax dues by the Comptroller's Office and additional penalties.

Reporting Methods

Webfile

The Texas Comptroller highly recommends using Webfile for tax reporting due to its efficiency and security. Webfile is an online portal accessible through the eSystems platform, allowing permit holders to file various tax reports, including Mixed Beverage Gross Receipts and Mixed Beverage Sales taxes. Registration for a Webfile account requires a Webfile number, which is printed on correspondence from the Comptroller's office. This number is essential for setting up an account, which can be done following the instructions on the Comptroller’s Getting Started page.

The Webfile number acts as a unique identifier for your business, essential for accessing the online filing system. It ensures that your tax filings are correctly associated with your permit and business account.

Texas Franchise Tax Public Information Report.

It's worth noting that the Webfile system is also utilized for filing the Texas Franchise Tax Public Information Report, which is due in May each year. This highlights the importance of familiarizing yourself with the Webfile system for comprehensive tax reporting.

Hard Copy Forms

While electronic filing is encouraged for its convenience and environmental benefits, the Comptroller's Office also accepts hard copy forms. However, this method is not recommended due to slower processing times and the increased risk of errors.

How to Calculate and Pay Mixed Beverage Taxes

Calculating the Payments

To calculate the Mixed Beverage Gross Receipts Tax, you take the total amount of your gross receipts from the sale of mixed beverages and apply the 6.7% rate. Again, this tax cannot be passed on to customers and must be absorbed by the business.

For the Mixed Beverage Sales Tax, if you choose to add the tax to the customer's bill, simply apply the 8.25% rate to the sale price of the mixed beverage. Alternatively, if the tax is included in the price of the drink, you'll need to back out the tax from the gross receipts to determine the taxable amount.

Payment Methods

The Texas Comptroller's Office offers several methods for paying these taxes:

Webfile: A secure, online portal for filing and paying your taxes. It allows for early filing and post-dating of electronic check payments. This is the recommended method for its convenience and efficiency.

Electronic Data Interchange (EDI): Suitable for businesses with a large volume of transactions.

TEXNET: Required for taxpayers who paid $500,000 or more for a specific tax in the previous state fiscal year. It's an electronic funds transfer system.

Credit Card Payments: Available through Webfile, but note that this method incurs a non-refundable processing fee.

Payment Due Dates

Both taxes are due on the 20th day of the month following the end of the reporting period. It's crucial to meet these deadlines to avoid penalties and interest charges. For those who might face difficulties in meeting the deadline, the Comptroller's Office does consider extension requests on a case-by-case basis. Remember that reports are due even when there are no sales and no payment is due.

Penalties and Interest

Late payments are subject to penalties and interest. The specifics can vary, but generally, a 5% penalty is assessed for payments made 1-30 days late, with a 10% penalty for payments made more than 30 days late. A $50 late filing penalty is also imposed on every report filed late.

FAQ: Can I pass the taxes on to customers?

Mixed Beverage Sales Tax: YES

Yes, businesses can pass the Mixed Beverage Sales Tax to customers. This tax is applied to the sale of all mixed beverages, and businesses have the flexibility to add it as a separate line item on the bill or include it in the overall price of the beverage. The key is transparency; customers should be aware of the tax they're paying, whether it's itemized or included in the drink's price.

Mixed Beverage Gross Receipts Tax: NO

In contrast, the Mixed Beverage Gross Receipts Tax cannot be directly passed on to the customer. This tax is a percentage of the gross receipts from the sale of mixed beverages and must be absorbed by the business. However, businesses are allowed to inform customers of this tax on their receipts. This means you can state the amount of gross receipts tax you're paying on the customer's purchase, providing clarity without directly charging them.

Examples from the Texas Comptroller

The Texas Comptroller's website provides specific examples, detailed calculations, and guidelines for accurately calculating and displaying these taxes to your customers.

Mixed Beverage Sales Tax Included: A receipt may list various items purchased, with a note at the bottom indicating that sales and mixed beverage sales taxes are included in the listed prices.

Itemized Mixed Beverage Sales Tax: Alternatively, a receipt could break down the cost of items and then separately list the mixed beverage sales tax, showing exactly how much tax was added to the total.

Gross Receipts Tax Disclosure: A receipt might also include a note explaining that, although the mixed beverage gross receipts tax is not charged to the customer, it is paid by the establishment on the sale of mixed beverages.

For the most accurate and up-to-date examples, businesses should refer directly to the Texas Comptroller's website.

FAQ: Why is the Texas Comptroller asking for a bond?

The Texas Comptroller mandates mixed beverage tax bonds as a form of financial assurance. This requirement is in place to ensure that businesses engaged in the sale of alcoholic beverages comply with the state's tax laws. A mixed beverage tax bond serves as a guarantee that the business will fulfill its tax collection and payment responsibilities as per state regulations. This measure is part of the state's effort to maintain a regulated and compliant marketplace for the sale and consumption of alcohol.

The bond amount and specific terms vary depending on factors such as the type of permit the business holds and its projected monthly sales. Generally, the standard bond amount is $3,750 for a mixed beverage sales tax bond and $3,750 for a mixed beverage gross receipts tax bond. After your TABC mixed beverage permit or private club permit is issued, the Comptroller will send a request for these bonds, so it's important to regularly check your mail for this correspondence.

Conclusion

Understanding and complying with the mixed beverage taxes in Texas is vital for any business involved in the sale of alcoholic beverages. By accurately calculating your tax obligations, choosing the right payment method, and adhering to the payment schedules, you can ensure your business remains in good standing with the Texas Comptroller's Office. For more detailed information, including step-by-step guides on filing and payment, visit the Texas Comptroller's official website

Still have questions about the Texas Comptroller requirements related to Texas liquor licenses? Contact Us or Book a consultation with Ashley, attorney for Storm Liquor License.

Disclaimer: This information is intended for educational purposes only. Nothing in our articles or on our website is legal advice and should not be taken as such. Please address all legal questions to your counsel.

TABC Food and Beverage Certificates Explained

Navigating TABC Food & Beverage Certificates is crucial for businesses in the foodservice industry. Discover the eligibility options, benefits, and audit process for certificate holders. Ensure compliance and explore how this specialized permit can elevate your business. Learn more in our blog post!

Setting the Foundation: Understanding City, County, and Comptroller Certifications for Your Texas Liquor License

Understanding Wine ABV Restrictions for Retailers

If you're considering opening a business involving the sale of alcoholic beverages, it's important to understand the specific regulations and restrictions applicable to your location. One restriction, particularly in certain areas of Texas, pertains to the alcohol by volume (ABV) content of wine that can be sold. In this blog, we will explore the details of ABV restrictions.

Meeting TABC Posting Standards: A Practical Guide for Texas Bar & Restaurant Owners

Stay compliant with Texas law by fulfilling the signage obligations enforced by the Texas Alcoholic Beverage Commission for TABC-licensed establishments selling alcohol for on-premises consumption. From posting your Texas liquor license to health risks warnings, public information/complaint signs, and human trafficking warnings, ensure your establishment meets all necessary signage obligations for a professional and law-abiding operation

Understanding the Costs Involved in Obtaining a TABC Liquor License

Discover the essential costs involved in obtaining a TABC liquor license in Texas. Our comprehensive blog post breaks down the various costs involved, including state fees for primary and secondary permits, local fees, the cost of publishing legal notices, and bond fees, to help entrepreneurs and business owners plan their budgets effectively.

The Importance of Seller Server Training: Promoting Responsible Alcohol Service

Discover the importance of Seller Server Training for bars and restaurants in Texas. Learn how this program, regulated by the Texas Alcoholic Beverage Commission, promotes responsible alcohol service and protects owners from liability. Explore topics covered, TABC-approved courses, and the benefits of implementing responsible alcohol service policies.

Reporting a Breach of the Peace in Texas: What You Need to Know

This blog post explains what constitutes a breach of the peace, the types of breaches that must be reported, and the consequences of failing to report them. You'll also learn how to make the report and the exceptios to the rule. Don't risk penalties or permit suspension; stay compliant with TABC regulations by reading this informative blog post.

Simplifying Compliance Reporting with TABC’s Voluntary Self-Inspection Process

The Texas Alcoholic Beverage Commission (TABC) has recently announced a new voluntary self-inspection process for businesses to conduct their annual compliance reports. This replaces the mobile app that businesses previously used and offers a simplified, more convenient method to conduct compliance reporting. In this blog post, we’ll go over the details of the new voluntary self-inspection process, its benefits, and how businesses can participate.