For entrepreneurs and business owners venturing into the world of on-premises alcohol sales and service, acquiring a Texas Alcoholic Beverage Commission (TABC) license or permit is a crucial step. The TABC is responsible for regulating and licensing businesses that sell or serve alcoholic beverages in the state of Texas. While the government charges their fee, it's important to understand the various costs involved in obtaining a TABC license or permit to effectively plan your budget. In this blog post, we will break down the expenses associated with obtaining a TABC permit, providing you with a clear picture of what to expect.

State Fees

The easiest cost to identify is the state fee collected by the TABC, which is due at the time you submit your application. You will likely have spent 30+ days preparing your application before submitting it, so there is no need to worry about spending these funds upfront.

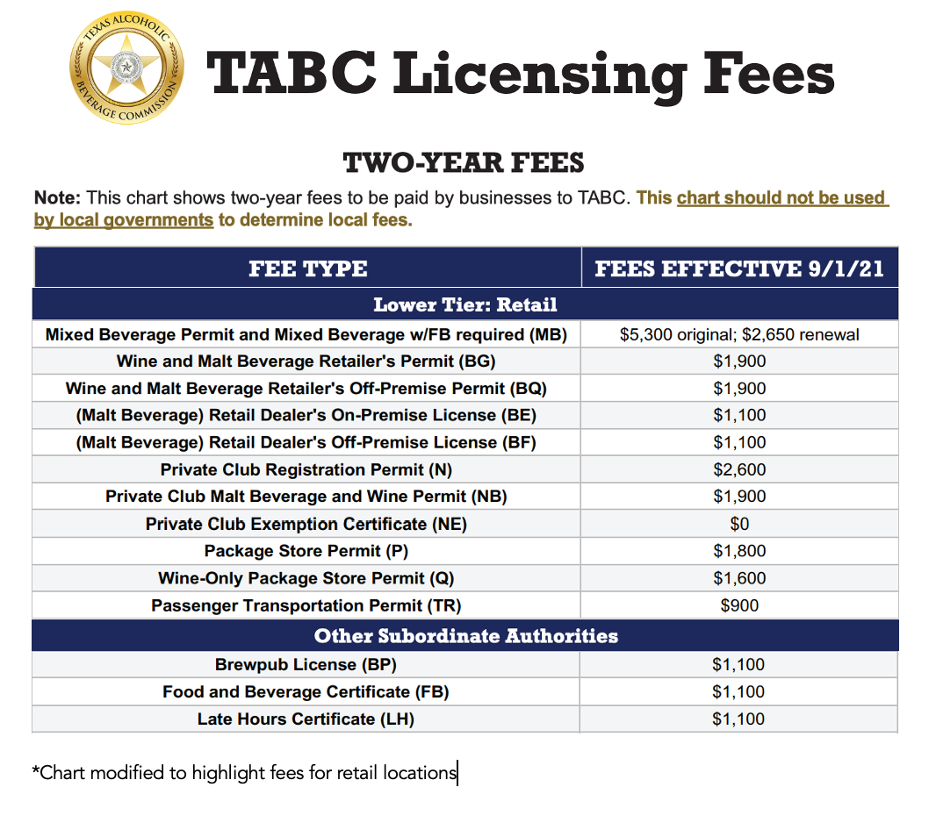

The TABC publishes its fees on its website in a helpful chart. We recommend referencing the TABC fees online as they may change from time to time, and the TABC does not always broadcast changes to forms or policies.

Primary Permit Fees

To calculate your state fee, you will first need to determine the primary permit you need. The two most common primary permit types for bars and restaurants are mixed beverage permits and wine and malt beverage retailer’s permits. As of June 2023, a mixed beverage permit costs $5,300 for the initial permit and $2,650 for renewals (every two years), while a wine and malt beverage retailer's permit costs $1,900 for both the initial permit and any renewals.

Secondary Permit Fees

In addition to the primary liquor license or permit, you may need to consider the cost of secondary permits, such as a food and beverage certificate, late hours certificate, and brewpub license.

Food and Beverage Certificate

The food and beverage certificate is a common secondary permit that may be required as part of a primary permit. Whether it is required or discretionary depends on the wet/dry status or zoning of your location. Even if it is not required, some businesses choose to obtain it voluntarily.

Holding a food and beverage certificate generally requires offering multiple entrees whenever alcohol is being sold and either having a commercial kitchen or ensuring that alcohol sales do not exceed 60% of total sales. Here is a TABC explanation of the food and beverage certificate eligibility requirements. Speak to your attorney if you have specific questions about whether or not you qualify for a food and beverage certificate.

The cost of a food and beverage certificate is $1,100 every two years as of June 2023.

Other Secondary Permits

Apart from the food and beverage certificate, there are a couple of other common secondary permits: the late hours permit and brewpub license.

The late hours certificate costs $1,100 and allows you to stay open later than midnight. It is available in larger cities or in cities that have passed an ordinance allowing late hour sales in their area.

The brewpub license also costs $1,100 and can be added to a mixed beverage permit or a wine and malt beverage retailer's permit, allowing the holder to engage in brewery-like activities.

Catering permit required? No need to add to your TABC permit budget if you intend to cater events. Texas law no longer requires a separate secondary permit for catering. Catering, or a "temporary event" as referred to by the TABC, is authorized by the primary permit (mixed beverage permit or wine and malt beverage retailer's permit). However, you still need to notify the TABC before private events (e.g., catering a wedding) and obtain approval for public events (e.g., selling alcoholic beverages at a festival).

Local Fees

When developing a bar or restaurant concept, it is important to understand that the city and county, in addition to the Texas Comptroller, must approve your TABC application before you can submit it to the TABC.

Pro Tip: Before navigating the TABC's Alcohol Industry Management System (AIMS), focus on obtaining your city and county certifications. You can use the TABC Required Certifications form as a first step instead of the AIMS-generated form, which is only available at the end of the AIMS process.

Admin Fees

Cities and counties are limited by Texas law in terms of what they can charge for processing your alcoholic beverage permit or license. They can only charge an administrative fee at the application stage, with costs ranging from $5 to $100 statewide. Some jurisdictions do not charge a fee at all.

Cost of Alcohol Measurement Survey

In addition to the processing fees charged by cities and counties, they may also request other items that will incur additional costs, such as an "alcohol measurement survey." It is important to note that a standard survey is not sufficient for this purpose. An alcohol measurement survey is a specific survey conducted to identify and disclose any nearby "protected places" to the city.

Only certain cities require this survey, while others conduct their own investigations. The City of Dallas and the City of San Antonio, for example, require an alcohol measurement survey, which typically costs around $300 based on our experience.

City Permitting Fees

Your local government can charge you for related permits, including building permits, certificates of occupancy, variances, zoning changes, and other requirements. The city or county may require compliance with local regulations before signing off on your TABC application. Make sure you are aware of the time and cost involved at your specific location.

Local Fee Authorized by State Law

After your permit is approved by the TABC, it is important to note that the city (or the county if you are located outside city limits) can legally assess a fee up to half of your TABC permit fee. While they are not obligated to assess this fee, most jurisdictions do.

Fortunately, for mixed beverage permit holders, the city or county must wait for three years before assessing the fee, resulting in a reduced renewal fee ($2,650). Unfortunately, wine and malt beverage permit holders are not subject to such waiting periods. As soon as your permit or license is approved, it is not surprising to receive a fee assessment from the city for $950 (half of $1,900).

Cost of Publishing Legal Notice

As part of preparing your TABC liquor license application, you should expect to incur the cost of a legal notice that you will be required to post. The approximate cost ranges from $200 to $300. Texas law mandates that applicants must run a specific legal notice in a locally circulated newspaper in the city or town where your establishment will be located.

To determine the exact cost, you will need to contact the newspaper and request a quote. Most newspapers charge based on the length of the notice, which can vary depending on the number of individuals in management.

One important note about the legal notice is to ensure that you identify the correct newspaper. It must be a newspaper of regular circulation in the city where your business will be located. Even if it is more convenient, you cannot use a large city's newspaper if you are in a small suburb of that city in the next county. You must use the local newspaper.

It can be frustrating when your local newspaper only runs weekly, but you still have to use it. If you have any questions about this, contact your local TABC office to confirm if a certain newspaper is acceptable for your location. It is essential to avoid submitting your TABC application and then having it rejected because the TABC determines that you used the wrong newspaper.

Additionally, keep in mind that the most widely recognized newspaper may not be the only option. For instance, in Dallas, the Dallas Morning News is a popular newspaper, but there are other newspapers like the Daily Commercial Record that have regular circulation in Dallas. Calling different newspapers and comparing prices can save you a few hundred dollars based on our experience.

Bond Fees

Next, let's discuss bonds. Several bonds are worth noting, some required before your permit is issued and others required afterward.

Conduct surety bonds and performance bonds are necessary if you are selling alcohol for on-premises consumption, as mandated by the TABC. The specific bond required depends on your permit type. Obtaining a bond is typically a straightforward process and costs around $300 to $400, depending on the bond amount and your creditworthiness.

Mixed beverage tax bonds are required by the Texas Comptroller for mixed beverage permit holders. After your permit is issued, you should anticipate receiving correspondence from the Comptroller requesting you to post a bond to ensure the payment of taxes. These bonds usually cost a few hundred dollars.

Understanding and budgeting for expenses beyond the TABC state fee is essential for entrepreneurs and business owners entering the realm of on-premises alcohol sales and service. With careful planning and an understanding of the costs involved, you can set your business up for success in the regulated world of alcohol sales and service.

Still have questions about the cost of a TABC liquor license for your specific bar or restaurant? Book a consultation with Ashley.

Disclaimer: Nothing in our articles or on our website is legal advice and should not be taken as such. Please address all legal questions to your counsel.